Secure Your Legacy with Strategic Estate Planning

Estate Planning: Protect Your Future Today, Your Family's Tomorrow

Discover how comprehensive estate planning can safeguard your assets and ensure your legacy endures, by aligning your financial goals with robust estate planning to create clarity, and achieve peace of mind.

Understanding Estate Planning

Estate planning is a crucial process that involves organizing and managing your assets to ensure they are distributed according to your wishes after your passing.

It encompasses a variety of legal documents, including wills, trusts, and powers of attorney, which collectively protect all that you’ve worked for and provide for your loved ones.

By planning your estate, you can minimize taxes, avoid probate, and ensure that your financial legacy is preserved. This proactive approach not only secures your family’s future but also reflects your values and priorities, making it an essential component of comprehensive financial planning.

Estate Planning vs Financial Planning

Estate planning and financial planning are vital components in achieving your long-term financial goals. While they focus on distinct elements of your financial picture, they fundamentally represent similar principles applied in varied contexts, working together to achieve a balanced approach between growth and security.

Understanding how to implement both estate planning and financial planning strategies effectively is key to enhancing your financial trajectory.

A notable intersection between financial and estate planning lies in their shared ability to address tax considerations. A comprehensive financial strategy acknowledges the interconnectedness of life, empowering individuals to ensure that their loved ones and cherished causes benefit from a lifetime of thoughtfully planned financial decisions.

Estate Planning Solutions Designed Around You

D. I. Y.

There are numerous web-based options for you to do your own estate planning and design your own will or trust. If you are comfortable addressing every detail, understanding the nuances of each implication. It can be a tremendous cost-saver if you are up for the challenge, your circumstances are not complex, and your financial considerations do not any require professional advice.

Estate & Financial Planning

Your estate planning can be meaningful conversations guided by personalized professional expertise, as you collaborate closely with a dedicated estate planning attorney and your financial advisor, who address the legal, and financial implications of long-term planning, ensuring the best possible outcome.

If your estate is straightforward, leaning towards D.I.Y., but need to prioritize the financial aspects of your Trust, we can tailor your estate planning process using best-in-class technology developed with in-house trust and estate attorneys, modern, inclusive, and sophisticated yet very affordable.

Estate Planning Attorney

If your needs are far more complex and require uniquely specialized expertise that only an estate planning attorney can provide, there should be no question of cost when it comes to getting the best advice or which route should be the best for your family’s needs.

In this instance, we have numerous attorneys in various areas with whom we partner and highly recommend.

Estate planning goes beyond legal documents. The real impact comes from integrating the right financial strategy with your estate goals.

Most people are surprised to realize that creating a Trust is just the beginning. Families establish a Trust for their beneficiaries, only to learn later that it was never properly funded. Based on industry estimates, 50% to nearly 80% of Trusts end up this way. This high rate occurs because many people stop after creating the trust documents, failing to complete the crucial second step of funding their trusts. This is like building a beautiful home, but never moving your belongings into it.

We make sure that doesn’t happen to you by providing the guidance and expert strategies to ensure that your Trust is not a shell of legal documents. We do this by crafting a strategy that begins with simple, practical steps: re-titling accounts, updating ownership, and ensuring everything is aligned. Then we focus on the crucial step of designing the bridge from today to your ideal tomorrow to maximize the retirement you’ve always imagined, and ensure the legacy you leave for your family truly reflects your best intentions.

The Importance of Estate Planning

Did you know that the vast majority of Americans have no will or trust? This highlights a significant gap in estate planning, which can lead to unnecessary taxes, fees, and legal challenges.

%

Of Wealth Can Be Lost To Legal Fees, Probate, Taxes and Capital Gains

%

Of Families Have An Estate Plan In Place

In Legal Fees, Probate, Taxes And Capital Gains Avoided Through Estate Planning

What Is The Importance Of Integrating Financial Planning with Estate Planning?

Financial planning are the steps you take today, into tomorrow. It is an on-going process to mitigate taxes, making the best financial decisions, projecting what earnings will be, savings, major purchases, travel. As these steps occur in life, the bigger picture is how they will be later safeguarded to care for your family one day when you are not here to do so. Estate planning gives you that vital tool to bring today and tomorrow both into focus.

What estate planning can do for tax planning

The lifetime gift/estate tax exemption is $15M in 2026. For couples making joint gifts, $30M. This exemption has allowed affluent families pass along substantial wealth tax-free.

For the 99% of the population without this level of concern. Gifting strategies allow $19k per year and $38k per couple. Estate planning can benefit tax planning at a more basic level as well. Facilitating smooth asset transfers and safeguarding your beneficiaries to minimize conflicts and complexity, ensuring your wishes are carried out without concern.

What estate planning can do for financial planning

Creating an estate plan or a financial plan is not a one-time endeavor. It is essential to revisit these plans throughout your life, especially after significant events such as marriage, divorce, the arrival of a child, or the loss of a loved one, which may require updates to your existing arrangements. Regularly reviewing and adjusting your legal documents and financial goals as your situation evolves is crucial.

By merging financial planning with estate planning, you can gain a comprehensive, insightful view of your financial landscape, including your assets, liabilities, income, and expenses. This knowledge empowers you to make well-informed choices about your financial future and the enduring legacy you intend to leave.

What life estate planning can do for retirement planning

If your income reaches a certain limit, you lose the option to save within a ROTH retirement account, unless you’re lucky enough to have a ROTH 401k option at work. Most have traditional 401 (k) s, 403 (b) s, 457 (b) s, or IRAs, all taxable accounts, all with required minimum distributions in your early to mid 70s.

Following retirement account rules and restrictions, funding amounts are well defined for the most part; the minimum age to access funds, avoid penalties, and Roth conversions are the details that require a strategy to live well in retirement.

Estate planning means strategically understanding which accounts to access in the best order to minimize taxes and maximize distributions, while positioning your assets so you live your best retirement and leave the best legacy possible.

What estate planning can do for business planning

One day, your business is your life. One day, you’ll decide it can’t be. You’re going to want to monetize it as much as possible to achieve the best possible exit strategy. You’ll need business valuations and plans to make the most of what you spent your life building.

Business succession planning needs to occur long before debating when to retire. Estate planning can help you plan how to walk away while minimizing taxes on a sale and securing a dedicated stream of income. This allows you to enjoy the lifestyle you deserve and build a legacy for your family.

What estate planning can do for legacy planning

It is common for you to feel that you need to choose to live for yourselves, or live for the legacy of your family you wish to leave behind. The truth is, with proper estate planning, one does not have to come at the cost of the other.

Whatever legacy you wish to create will be improved by planning for it. Substantial or thoughtful, your family wants you to live out the life you deserve. No matter what, you will help them start a future legacy of their own.

What estate planning can do to protect your income

Estate planning goes hand in hand with financial planning. As you plan your next chapter, part of that involves the “what ifs”. In that planning, you consider how your spouse will continue without you, you without them. Things like going from married filing jointly to single, a lower pension now, or a higher percentage continuing to your spouse, taking social security earlier or later, or working an extra year or two are all factors that can change the outcome.

Estate planning can protect not just retirement income, but also what it could mean when you are not there to see things through.

What estate planning can do to extend charitable giving

Apart from your altruistic inclination to leave financial support to the meaningful causes in your life, estate planning can create unforeseen windfalls.

Your bequests can be larger by leveraging estate planning. When RMDs come along, and income sources exceed your needs, planning can potentially reduce taxable income. If you were to transfer ownership and beneficiary designation, you or your heirs could gain a tax deduction. Estate and tax planning allow us to design this based on your needs.

Even if income is needed, you can use life insurance to structure a charitable gift annuity, a charitable remainder unitrust, or an annuity trust life income gift, which can provide you with income during your lifetime.

When you’ve done your research and recognize that your estate planning requirements fall somewhere between a do-it-yourself approach and the need for expert financial advice, we are here to offer a tailored solution and affordable approach that maintains the highest legal standards.

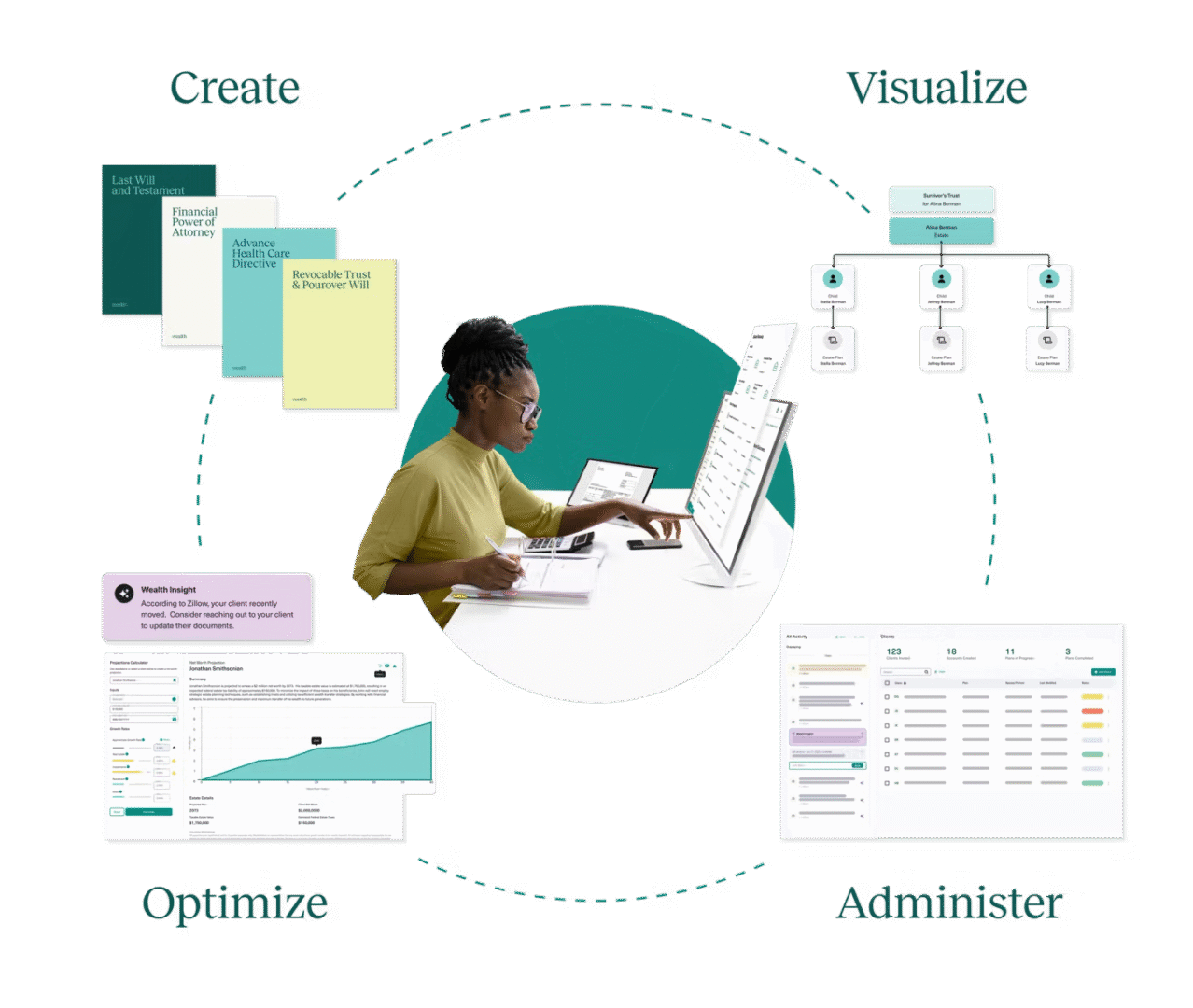

A technology platform designed for the relationship between clients and advisors, that recognizes that being prepared can be far more than just a properly prepared estate planning documents

Tax Smart Investing & Planning, focused on the best outcomes of our clients

At Tax Smart Investing, we provide you with valuable advice to enjoy your lifestyle while making informed financial decisions at every life stage, even embracing a few bold risks as long as you’re aware of the potential consequences.

Throughout this journey, financial planning evolves into tax planning and integrates estate planning, allowing you to enjoy your ideal lifestyle today while thoughtfully preparing for your family’s future when you are no longer here. These vital elements go beyond mere spreadsheets and software; they stem from meaningful conversations about what truly matters to you.

We are your dedicated guide, navigator, and trusted partner, ensuring that your version of an enriched life is fully realized.

Creation of high caliber estate plans with state-optimized legal documents

- Revocable Trust & Pour-over Will

- Last Will & Testament

- Financial Power of Attorney

- Advance Health Care Directive

- Guardianship Nominations

Delivering and optimizing best-in-class solutions

Designed and built by experts in trust and estate law, vetted by trust and estate planning attorneys, Wealth provides a customized estate plan based on your unique circumstances and preferences.

Wealth isn’t a one-size-fits-all document creation wizard like many other available options. It’s a financial technology platform that bridges the gap between the wealth you’re working hard to build today and the legacy you wish to leave behind. State specific documents, optimized for, and available in, all 50 U.S. states and D.C.

You can feel confident that your personal information remains completely safe thanks to the secure document storage protected by the bank-level encrypted digital Vault.

Unprecedented Value

For an experienced estate planning attorney, a traditional estate plan (Trust package) typically costs between $2,000 – $4,000.

If you have a simple structure that leans you towards D.I.Y. but want to get the financial side of your estate planning right, by choosing Tax Smart Investing for prudent financial guidance and Wealth for unsurpassed legal expertise, you can enjoy substantial savings while benefiting from the best of both worlds.

Your estate plan to access as you need

Working with Tax Smart Investing & Wealth provides you with unlimited access to the most comprehensive digital estate planning solution available, ensuring that when life events create change, you own your Trust, it’s your license, and you can make the updates needed. Wealth maintains the software with the most up-to-date and pertinent tax and estate laws as they occur in all 50 states.

Begin Your Estate Planning Journey Today, And Secure Your Legacy For Tomorrow

Let’s get started with a conversation about what matters most to you, so we can preserve it for generations to come.