Planning Retirement

Long before retirement seemed real, you’re taking steps to prepare, as every year passes, are you ready?

Pre-Retirement Goals

You’ve had career, income, and savings goals to forecast the lifestyle that you’ve imagined for retirement. How well have things gone to plan? It may be time to see if you are on track or to ensure that the plan is sustainable.

Retirement Income Goals

No one wants their lifestyle to change in retirement. Basic expenses can be easily met, but planning retirement properly means that lifestyle, medical and unforeseen expenses don’t represent challenges in the future.

Retirement is the only time in life when time no longer equals money

Planning retirement is crucial as it can last 1/3 of your life. You should make sure your savings lives longer.

The ideal outcome of retirement planning can be measured by the number of options that you have, rather than the limits you have to live with.

Planning retirement for allocating enough - enhance what you're already doing

Considering ROTH conversions to reduce taxes in retirement

Consolidating retirement assets from previous employer plans

Social Security planning strategies for individual and spousal considerations

Planning retirement early to address income, healthcare and expenses

Debating financial planning, but want to make sure your expectations are met

How should your investments change as your are preparing for retirement

Diversifying your investments - how much risk is appropriate given your goals

Taking appraisal of your financial state as compared to your lifestyle needs

Consideration of mortgage pay-off, downsizing, or investment property

Planning retirement while extending financial support to loved ones

Withdrawal strategies to satisfy needs while being as tax efficient as possible

Maximize tax efficiencies for gifting to loved ones and meaningful causes

Protecting spouse and loved ones and your estate through wills and trusts

Designing healthcare plan and directives, including pre-planning cost efficiencies

Legacy planning for tax efficient wealth transfer

Addressing the tax considerations of being retired but continuing to work

401(k) / IRA Advice

You’re closing in on retirement, or already have and wondering how to manage your retirement assets as you transition into living on savings. Distributions for income should be planned in advance for normal expenses and lifestyle needs and shrewdly for your unplanned needs.

Tax-Smart Investing

As you are approaching or have made it to retirement, how differently should you look at your investments? We can show you how you can still benefit from growth with less risk and reduced tax drag.

Financial Guidance

Social Security planning, rollovers, tax-efficient income withdrawals, being prepared for emergencies, all these, and more are questions that need to be answered to before you need them.

Business Planning

There is a very different mindset when you are considering how to exit, transition, or sell your business when you are ready to retire. We can walk you through the steps and how to do it tax-efficiently.

If life has thrown you a curveball, leaving you unsure, are prepared for what’s next?

Having enough money to retire comfortably isn’t always the primary goal. Planning retirement when your plans have taken unexpected turns can create challenges that may leave you feeling less than prepared.

Our kids are grown and we can live somewhere we've always dreamed, does it make sense?

Downsizing your family home can be an emotional, but financially practical step, but relocating altogether can seem daunting. There are numerous details to address, such as cost of living, taxes, climate, and healthcare considerations.

There is also the priority of travel arrangements when you want to visit loved ones. Planning retirement can be more complex than you originally planned. We can help you weigh your options and point out the important concerns to make your plans work for you.

I expected to retire as a couple and now I have to go it alone.

Losing the love of your life is devastating. Nothing can prepare you for such a tragedy. As much as you know that your spouse would have wanted you to move forward with the plans that you made together, you realize that everything has changed. Perhaps there is unfinished business, selling of a home, selling or closing of a business, or even maybe the finances weren’t your department, and trying to figure it out now feels like you might make a mistake.

Avoiding making mistakes with your finances is just a matter of understanding the financial implications of your choices. Your focus should be to follow what is in your best interests and we can point out the financial implications along the way so you can confidently make decisions to serve you well.

I don't know how to walk away from my business without being killed by taxes.

Not everyone gets to retirement with a pension or hefty 401(K) waiting for them. Sometimes putting your life’s work into a business of your own has been all you ever wanted and you just assumed one day your sunset would come. Now you find yourself in uncharted waters, unsure of how to liquidate, sell, or even maintain, but walk away from day-to-day operations. Your financial assets may be tied into your business and your employees are your family. Perhaps you have no logical successor, and you can’t just sell to anyone.

There are more options than you might imagine to address your concerns as well as how to prepare for the taxable implications that will be a part of whatever decision you make. We can help guide you to your ideal resolution and bring in the professionals you will need to execute your wishes without fail.

Being faced with health changes can be tough, being financially prepared is your best defense.

Having a family history that presents potential health concerns, or perhaps just knowing how to align your needs with measures to prepare for the unexpected may provide you with the peace of mind you need. Having your will and trust in place, long-term care coverage and even life insurance can be the lifeline you need when having to face serious health issues.

Preplanning can take the burden off your loved ones, but if early planning never took place, knowing where to best access the money needed, with the least financial and tax impact is crucial. We can take you through your options step-by-step through the difficult, but necessary choices to see to it that your needs can be met as best they can.

Early retirement can be challenging, designing the ideal strategy for your needs can make it possible.

Under the best of circumstances, retiring early can be a serious challenge. Some of your assets will need to be directed at income-producing investments, while others with higher risk, are not intended to access until down the road. Medicare options are not yet available and accessing social security is not ideal until you reach full retirement age. Passive income can help bridge the gap if you planned well along the way, but you also don’t want every penny you touch to be taxable income.

We can help guide you through the world of tax-free, tax-deferred, and tax-smart investments. Most but not all opportunities present risks but being armed with sound advice can make your challenges less daunting.

How Would This Work?

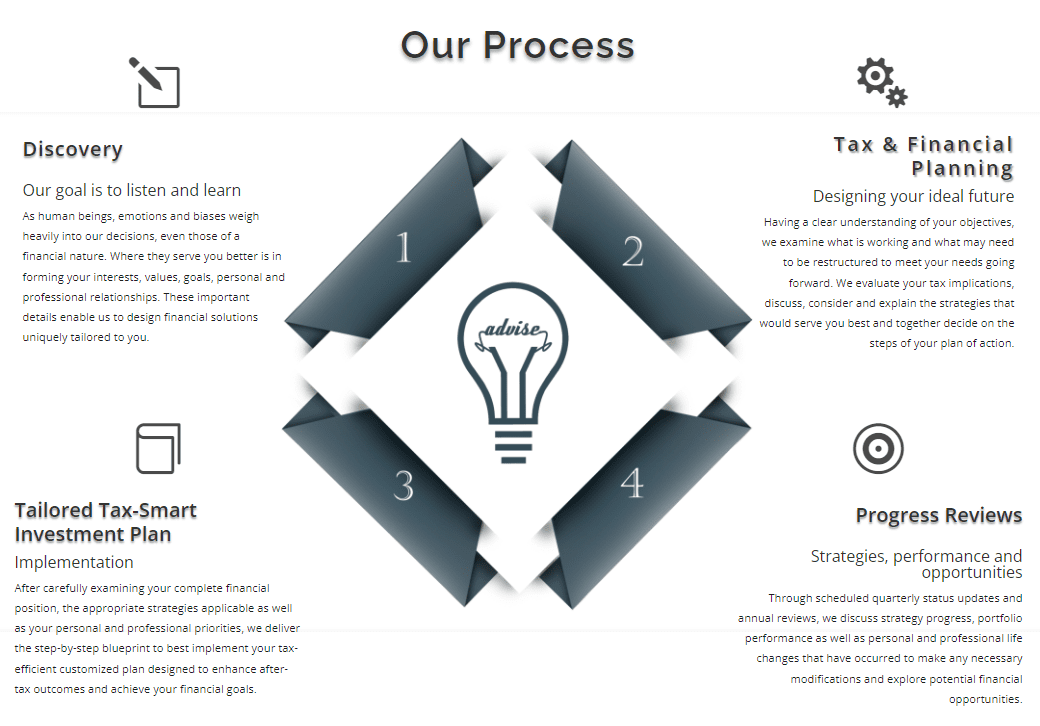

Generally, as all meaningful things do, it all begins with a conversation. In that conversation, you can expect to be asked about what and who matters to you, what your goals look like today and tomorrow, and how and what you think about money. As wealth advisors, we lend some expertise and perspective, and you decide if there is value in exploring further conversations.

Our clients earn high five figures, through high six and seven-figure incomes. Some are starting out while others are enjoying closing their lives after successful working careers. Many of our clients work for great companies and many run great companies. What we have learned by being privileged to work with our clients, is that no two are the same and that each lends a unique perspective that benefits others.

We approach each new client relationship with a commitment to creating value in our interactions, no preconceived notions, and no preset, cookie-cutter strategies. We also won’t tell you that you should sacrifice your lifestyle today for a better one tomorrow. What matters to you is at the center of our perspective.

You Decide How We Work Together

Flexible options to engage in financial advice in the way you prefer

You may have done a great job developing and maintaining your financial portfolio and perhaps all you need is an occasional review of strategies and sound advice for major financial planning considerations as they present themselves. In this case, we are here for you as needed, providing advice on an hourly basis.

You may prefer to have a dedicated team to design your short-term and long-term strategies to manage and monitor your financial world through an open line of regular communication and financial goal planning of your work and personal investments. In this case, we are here to provide advice on a regular basis as a traditional percentage of assets under management, working as your partner to navigate challenges and capture the opportunities.

You may have a situational need for a specific goal and require an unbiased opinion. This generally means a specific product solution, which compensates a representative with a commission for placing business with them. As an independent firm, we work with all major A-rated companies and have no ties or requirements to any one company, solution, or product. This allows us to honor our duty to focus on the best possible solution for your needs rather than a company controlling and restricting our options, or compensation weighing unjust bias into any recommendations.

We are all products of our decisions, favorably and unfavorably. You will succeed in any endeavor if you take the time to understand how things work and whether or not the reward is worth your efforts. As with all challenges you have taken on, lessons were learned in the process; shortcuts you could have taken, the money you could have saved, and steps you could have avoided. Planning retirement in advance will give you an edge over playing catch-up later.

Your Life, Your Goals, Your Path. Your priorities become our beacon for guidance.

Long-term financial decisions can benefit from knowledge and expertise. By planning retirement we can show you how to make the most out of whatever challenges face you, and how to take advantage of opportunities you may have not realized were there.