Business Professionals

You’ve made your own success and are considered a valuable asset. It’s now time to take financial appraisal of your personal assets and create opportunities in your highest earning years.

Personal Life Goals

You have specific goals that represent everything you have accomplished in your personal life. Optimizing your work, life balance now means aligning well defined financial goals for the future.

Career Goals

You’ve made things happen, with a lot of hard work and some strategic choices. Any new challenge is a balanced decision between career aspirations, quality of life, and enhancing financial opportunities.

Providing Support For Your Financial Success

Your wealth advisors should help you align your financial decisions of the past with your best interests for tomorrow

You’ve made numerous financial decisions throughout the years and the importance that they still fit into your future is where a wealth advisor can help you identify any concerns. Your perspective and goals are unique, your financial advice should be no different.

Allocating enough for retirement - are you on track

Are you making the most of your 401(k) - anything more proactive you can do

Taking appraisal of your financial state as compared to your future plans

Financial strategies to best support both your current and future needs

How to best balance your retirement and college planning for your children

Balancing taxable, tax-deferred, and tax-free considerations

Diversifying your investments - how much risk is appropriate given your goals

Deductions, withholdings, capital gains - can you be more tax efficient

Managed DIY investing well - can you accomplish more with a wealth advisor

Debating financial planning, but want to make sure your expectations are met

Home equity - should you leverage for investment purposes or just pay off early

Should you consider ROTH conversions to minimize future tax concerns

Retirement assets in previous employer plans - should you move, what's best

RSU/stock options, navigating your best options

Navigating the financial challenges of running your own company

401(k) Advice

Fund options, traditional vs ROTH, company match, contribution amounts, W2/self-employed. There are so many considerations, get advice catered to your specific needs.

Tax-Smart Investing

Being focused on growth doesn’t mean that you have to live with considerable capital gains. Benefit from long-term growth with reduced tax drag.

Financial Guidance

Financial planning can shed light on your best path to your goals, but the approach you take can present more choices than you may think. Explore your options.

Business Planning

Thinking about making the leap or already running your own company? Even solo entrepreneurs can benefit from strategic planning for success, or even staging the best exit strategy.

What can a wealth advisor do that I can’t do for myself? Why should I consider making a change now?

Being capable enough to manage any challenge is both a learned and honed skill, but some decisions can benefit from perspective.

I make a comfortable living, but I don't consider myself rich, so why bother?

How do you approach money? Are you doing what you think you should be doing, researching the web, subscribing to financial forums, advice from friends you respect, peers, and family? You can’t implement a financial strategy if you are not aware of it, even then is it completely applicable to you. How are you sure to apply it successfully, and are there circumstances that make it ideal for you now but not later, or vice-versa? Getting good, sound financial advice is based on getting more value than your expense. Also, since it is based on complexity, it will likely be much more reasonable than you imagine.

I save for retirement, my investments have grown, I'm already succeeding.

Your life is fueled by your income. Your financial decisions have been based on making smart money moves. The question you might consider today is whether or not you are on financial “cruise control”. Things are constantly changing and not taking into account recent legislative changes that have created new tax opportunities, or if changes in financial services have created new strategies that you could benefit from. It’s our duty as wealth advisors to stay current with changes in the financial landscape. We serve our clients in a fiduciary capacity, constantly examining what is in your best interests, both as your life evolves, and as favorable short and long-term strategies emerge.

Why would I pay for financial advice that I can research myself?

Google can’t give you the right answer if you ask the wrong question. There are numerous citations in publications on the web to quantify the value of wealth advisors. As wealth advisors, our practice specializes in the tax implications of investments, wealth management, and business planning, we identify opportunities by finding gaps in efficiencies, and implementing unique approaches to financial considerations, adding evident value to your outcomes.

Also, as fiduciaries, our clients benefit from investments that are institutional holdings. If you are managing your own investments, or with a bank, your funds are likely in retail holdings. You deserve to be treated like a millionaire, even if your accounts are not there yet. We can show you the valuable difference.

I am not interested in being told how to spend, invest and save.

In the most traditional sense, most wealth advisors want to save their clients from themselves. Spending habits, risky investments, and a limiting lifestyle for a potentially “safe” retirement have been the norm. Your goals matter, your path is the variable. We believe in supporting your interests and goals by finding the path that speaks to you. We are the navigators, you are the driver.

I don't see how a wealth advisor can make me more money in the long run.

Seemingly insignificant, incremental changes can impact your long-term financial outcome just with a single adjustment to what you are already doing, often at no sacrifice of cost. There are numerous things you can do to make smart money decisions. Our focus on tax implications alone can reduce your tax drag, reducing taxable income, as well as capital gains. These factors impact outcomes year after year. As wealth advisors, our goal is to support you by identifying your opportunities, these are where our greatest value resides.

Also, as fiduciaries, our clients benefit from investments that are institutional holdings. If you are managing your own investments, or with a bank, your funds are likely in retail holdings. You deserve to be treated like a millionaire, even if your accounts are not there yet. We can show you the valuable difference.

My life is busy, between the needs of my kids and parents, I don't have time for this.

You could be in the “sandwich generation”, dealing with kids still at home, or even already out, but still helping them establish their lives, while at the same time, helping aging parents. Or maybe, that’s all still ahead of you, and you’re setting up what you believe to be the best path to your financial future. There is only value in what you decide is worth your time and effort. Working with a wealth advisor worthy of your trust can make a lifelong impact. We can help lend perspective to what you are going through, and what has yet to come.

If you choose to work with anyone for financial advice, make it on your terms, address your needs, and access the value you can gain (even in the first few conversations) by trusting your instincts that their interests are in your favor, not their own.

How Would This Work?

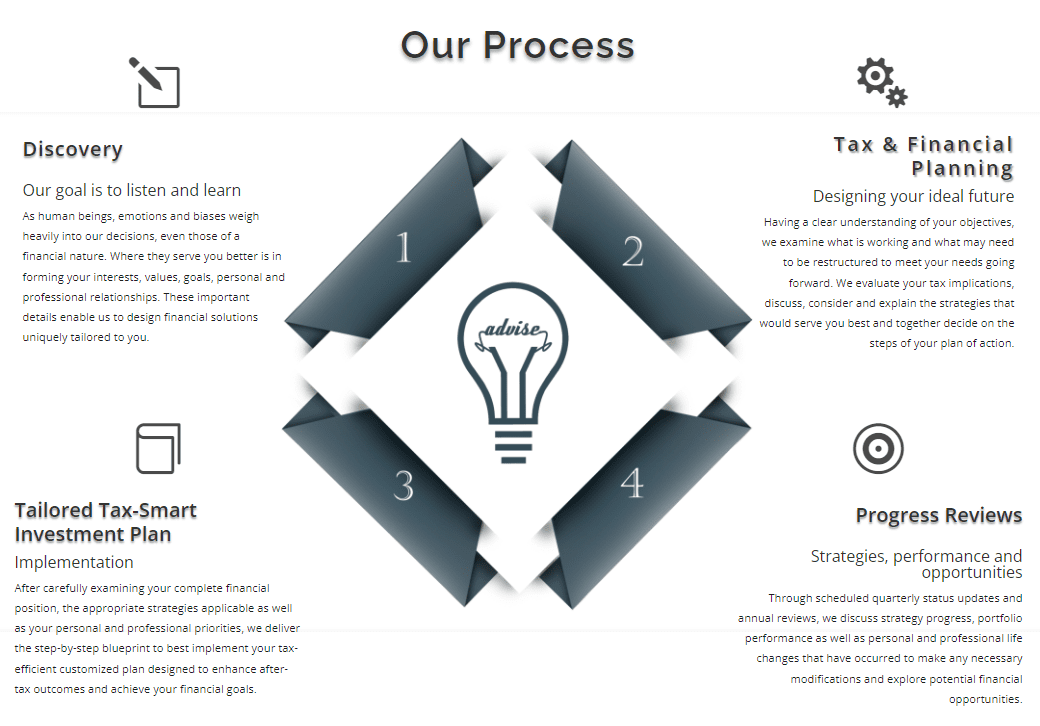

Generally, as all meaningful things do, it all begins with a conversation. In that conversation, you can expect to be asked about what and who matters to you, what your goals look like today and tomorrow, and how and what you think about money. As wealth advisors, we lend some expertise and perspective, and you decide if there is value in exploring further conversations.

Our clients earn high five figures, through high six and seven-figure incomes. Some are starting out while others are enjoying closing their lives after successful working careers. Many of our clients work for great companies and many run great companies. What we have learned by being privileged to work with our clients, is that no two are the same and that each lends a unique perspective that benefits others.

We approach each new client relationship with a commitment to creating value in our interactions, no preconceived notions, and no preset, cookie-cutter strategies. We also won’t tell you that you should sacrifice your lifestyle today for a better one tomorrow. What matters to you is at the center of our perspective.

You Decide How We Work Together

Flexible options to engage in financial advice in the way you prefer

You may have done a great job developing and maintaining your financial portfolio and perhaps all you need is an occassional review of strategies and sound advice for major financial planning considerations as they present themselves. In this case, we are here for you as needed, providing advice on an hourly basis.

You may prefer to have a dedicated team to design your short-term and long-term strategies to manage and monitor your financial world through an open line of regular communication and financial goal planning of your work and personal investments. In this case, we are here to provide advice on a regular basis as a traditional percentage of assets under management, working as your partner to navigate challenges and capture the opportunities.

You may have a situational need for a specific goal and require an unbiased opinion. This generally means a specific product solution, which compensates a representative with a commission for placing business with them. As an independent firm, we work with all major A-rated companies and have no ties or requirements to any one company, solution or product. This allows us to honor our duty to focus on the best possible solution for your needs rather than a company controling and restricting our options, or compensation weighing unjust bias into any recommendations.

We are all products of our decisions, favorably and unfavorably. You will succeed in any endeavor if you take the time to understand how things work and whether or not the reward is worth your efforts. As with all challenges you have taken on, lessons were learned in the process; shortcuts you could have taken, the money you could have saved, and steps you could have avoided. The value of a wealth advisor is found in these details.

Long-term financial decisions can benefit from the knowledge, expertise, and perspective of a client-focused wealth advisor. Let us show you how to make the most out of whatever challenges face you, and how to take advantage of opportunities you may have not realized were there.