Early Career Success

You’ve found success and surpassed the familiar, what’s next, and how do you do it right?

Personal Life Goals

You have specific goals that represent everything you hope to accomplish in your personal life. Optimizing work, life balance is important, but so is setting up your future financial goals for success. How do you decide your ideal path to get there?

Career Goals

You’ve made things happen, with a lot of hard work and some strategic choices. Taking on the next challenge could benefit from sound financial advice to enhance your financial opportunities along the way. How do you make sure to identify them?

Providing Support For Your Success

Align the decisions of today with financial advice that supports your best interests for tomorrow

There were always plenty of people to “share” their wisdom, even when you weren’t sure that you needed it. Your perspective and goals are unique, your financial advice should be no different.

Wanting to make the most of your 401(k)

RSU/stock options, navigating your best options

Marriage/partner, how to best bring together finances

How best to address student loan debt

Investing, but not clear on the long-term financial implications

Best strategies to purchase your first home or income property

Not sure if it's too soon for wealth planning, but wanting good financial advice

Financial planning sounds good, but not sure what you can get out of it

Balancing taxable, tax-deferred, and tax-free considerations

Navigating the financial challenges of running your own company

401(k) Advice

Fund options, traditional vs ROTH, company match, contribution amounts, W2/self-employed. There are so many options, get financial advice for your specific needs.

Tax-Smart Investing

Being focused on growth doesn’t mean that you have to live with considerable capital gains. Benefit from financial advice for long-term growth with reduced tax drag.

Financial Guidance

Traditional financial planning may seem premature, perhaps a financial guide for all your major considerations whenever you need is all that you need. Explore your options.

Business Planning

Thinking about making the leap or already running your own company? Even solo entrepreneurs can benefit from strategic planning to set yourself up for success.

You have done just fine without professional financial advice, why consider making a change now?

Being capable enough to manage any challenge is both a learned and honed skill, but some decisions can benefit from perspective.

I make a comfortable living, but I'm not rich yet, so why bother?

How do you approach money? Are you doing what you think you should be doing, researching the web, subscribing to financial forums, advice from friends you respect, peers, family? You need to be aware of certain strategies to apply them. If you do, are there circumstances that make it ideal for you now but not later? This is beneficial to understanding financial implications before they must be addressed.

Why would I pay for financial advice that I can research myself?

Google can’t answer everything, especially if you unknowingly ask the wrong question. There are numerous citations in publications on the web to quantify the value of professional financial advice. Our practice specializes in the tax implications of investments, wealth development, and business planning. We identify opportunities by finding gaps in unrealized inefficiencies, and implementing unique approaches to financial considerations, adding evident value to your long-term financial outcomes.

I am not interested in being told how to spend, invest and save.

In the most traditional sense, most financial advisors want to save their clients from themselves. Spending habits, risky investments, and a limiting lifestyle for a potentially “safe” retirement have been the norm. Your goals matter, your path is the variable. We believe in supporting your interests and goals by finding the path that speaks to you. We are the navigators, you are the driver.

I'll be smart with my money for now and once I am older I'll Iook for advice.

Seemingly insignificant, incremental changes can impact your long-term financial outcome just with a single adjustment to what you are already doing, often at no sacrifice of cost. There are numerous things you can do to make smart money decisions. Our goal is to support you by identifying your opportunities.

My life is busy, between the needs of my kids and parents, I don't have time for this.

You spend weeks researching before you buy a new car, your next TV, or whether to stick with Apple or finally try an android. There is only value in what you decide is worth your time and effort. If you choose to work with anyone for financial advice, make it on your terms, addressing your needs, and access the value you can gain in the first few conversations by trusting your instincts. As for convenience, make sure that virtual meetings, online resources, and scheduling that works for you are a requirement.

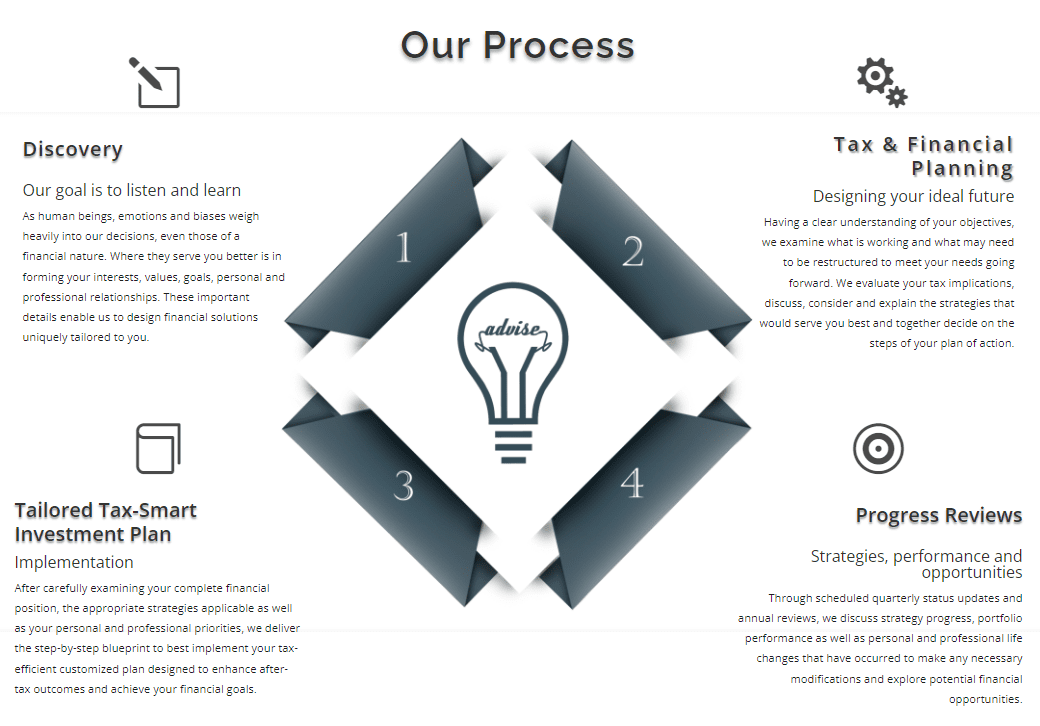

How Would This Work?

Generally, as all meaningful things do, it all begins with a conversation. In that conversation, you can expect to be asked about what and who matters to you, what your goals look like today and tomorrow, and how and what you think about money. As wealth advisors, we lend some expertise and perspective, and you decide if there is value in exploring further conversations.

Our clients earn high five figures, through high six and seven-figure incomes. Some are starting out while others are enjoying closing their lives after successful working careers. Many of our clients work for great companies and many run great companies. What we have learned by being privileged to work with our clients, is that no two are the same and that each lends a unique perspective that benefits others.

We approach each new client relationship with a commitment to creating value in our interactions, no preconceived notions, and no preset, cookie-cutter strategies. We also won’t tell you that you should sacrifice your lifestyle today for a better one tomorrow. What matters to you is at the center of our perspective.

You Decide How We Work Together

You may have done a great job developing and maintaining your financial portfolio and perhaps all you need is an occassional review of strategies and sound advice for major financial planning considerations as they present themselves. In this case, we are here for you as needed, providing advice on an hourly basis.

You may prefer to have a dedicated team to design your short-term and long-term strategies to manage and monitor your financial world through an open line of regular communication and financial goal planning of your work and personal investments. In this case, we are here to provide advice on a regular basis as a traditional percentage of assets under management, working as your partner to navigate challenges and capture the opportunities.

You may have a situational need for a specific goal and require an unbiased opinion. This generally means a specific product solution, which compensates a representative with a commission for placing business with them. As an independent firm, we work with all major A-rated companies and have no ties or requirements to any one company, solution or product. This allows us to honor our duty to focus on the best possible solution for your needs rather than a company controling and restricting our options, or compensation weighing unjust bias into any recommendations.

We are all products of our decisions, favorably and unfavorably. You will succeed in any endeavor if you take the time to understand how things work and whether or not the reward is worth your efforts.

As with all challenges you have taken on, lessons were learned in the process; shortcuts you could have taken, the money you could have saved, and steps you could have avoided.

Your life, your goals, your path. Your financial advice should uncover unexpected opportunities.

Long-term financial decisions can benefit from the knowledge and expertise that good financial advice can lend. Let us show you how to make the most out of whatever challenges face you, and how to take advantage of opportunities you may have not realized were there.